Social Network Analysis (SNA) surveys are often the first and most important step in understanding how relationships drive collaboration, resource sharing, and system performance. But crafting the right questions—ones that respondents can actually answer clearly—takes time, expertise, and testing.

This guide is built for public health departments, city and county agencies, nonprofits, foundations, evaluators, and university centers preparing to launch an SNA or CPRM project. You’ll find ready‑to‑use question wording, validated scales, and structure tips—everything needed to go from concept to field‑ready survey in a few hours instead of weeks.

Table of Contents

Asking the Right Question = Better Insights

A well‑designed SNA survey begins with choosing the right relational questions and measurement scales. This section provides the building blocks—name generators, tie strength metrics, and quality indicators—to help you collect clear, comparable data across projects.

Get our monthly newsletter with resources for cross-sector collaboration, VNL recommended reading, and upcoming opportunities for engaged in the “network way of working.”

How to Choose the Right Relational Question

Choosing the right relational question starts with clarifying what you want to learn and how the results will be used. Each step below narrows your focus, ensuring you design a survey that produces interpretable and actionable data for your specific context.

1. Define your unit of analysis

Decide if you’re studying relationships among organizations, teams, programs, or individual practitioners. The level determines how you phrase your name generator questions and what kind of data privacy protocols you’ll need.

2. Establish network boundaries

Identify who can be named in the survey. You can use a full roster (closed list), a bounded free recall list (within a known directory), an open free recall (any partner), or snowball sampling (where respondents nominate others who are later invited). Each approach has trade-offs between data completeness and discovery.

3. Detail what relationships matter

Be explicit about what kind of ties you’re measuring—information exchange, referrals, funding, coordination, governance/decision-making, advocacy, or service delivery. Narrowing this scope prevents confusion and reduces survey fatigue.

4. Choose measurement depth

Match your scales to the insight you need. Some projects only need frequency data; others may layer on perceived value, trust, or reciprocity. Multiplex designs (2–3 tie types) can capture complexity but require more response time.

5. Plan for analysis and deliverables

Think ahead to your desired visualizations—whether heatmaps, community detection, key player analysis, or longitudinal comparisons. Defining the end use ensures your questions align with analytical goals and platform capabilities, such as those in PARTNER CPRM.

53 Copy-Paste SNA Survey Questions

This curated list of 50+ SNA survey prompts gives you proven, field-tested question wording to capture relationship data accurately and efficiently. Each prompt is organized by tie type so you can mix and match based on your evaluation goals, network size, and time constraints.

Use them as-is or customize the phrasing to fit your community’s language, remembering to stay consistent in voice, tone, and scope.

💡Pro Tip: Prefix each prompt with your chosen time window (e.g., “during the past 12 months”) and context (e.g., “regarding [program/issue/community neighborhood]”) to ensure more relevant and comparable answers.

I. Information Sharing & Knowledge Exchange

Strong communication is the backbone of collaboration. These questions uncover how information flows within your network—who shares updates, advice, or data—and reveal the key connectors and knowledge brokers who keep everyone aligned.

1) List the organizations you regularly share information with about [topic].

2) Who do you go to first when you need guidance or best practices on [topic]?

3) Which partners keep you most up to date on policy/funding changes related to [topic]?

4) Name partners with whom you co-develop resources (toolkits, trainings) on [topic].

5) Who amplifies your communications (newsletters, social, events) to reach your stakeholders?

II. Referrals & Client Flow

Referrals reveal how services are coordinated and how clients move through systems of care. These questions help identify bottlenecks, redundancies, and the most critical pathways for client success.

6) Which organizations do you refer clients to for [service]?

7) Which organizations refer clients to you for [service]?

8) Who do you coordinate intake with to reduce duplicate screening for clients?

9) List partners with warm handoffs (case conferences, joint appointments).

10) Name partners you share eligibility criteria or data-sharing agreements with.

III. Funding & Resources

Resource relationships show how funding, space, and in-kind support flow across a network. Mapping these connections highlights where financial dependencies or collaborative opportunities exist.

11) Who provides you with funding or in‑kind resources (staff time, space, supplies)?

12) Which partners do you fund or support in‑kind for [initiative]?

13) List organizations you co-apply for grants with.

14) Who do you budget and plan with for shared initiatives?

15) Name fiscal agents or backbone orgs that manage funds on your behalf.

IV. Coordination & Joint Activities

Effective collaboration depends on day-to-day coordination. These questions explore how partners align their work, share staff or volunteers, and co-deliver events or services.

16) Who do you coordinate service delivery with (joint scheduling, co-location)?

17) Which organizations do you plan interventions with (logic models, workplans)?

18) Who do you share staff or volunteers with?

19) Who do you run events or trainings with?

20) Who participates with you in standing workgroups/committees?

V. Governance & Decision-Making

Understanding who has a voice in strategic and operational decisions helps you identify leadership structures and shared accountability. These questions illuminate power dynamics and governance models in your network.

21) Who do you make decisions with about strategy, priorities, or resource allocation?

22) List partners who approve protocols or policies together with you.

23) Which organizations set shared performance measures with you?

24) Who serves as a backbone/convener you rely on for direction?

25) Name organizations that hold you accountable for agreed outcomes.

VI. Advocacy & External Influence

Advocacy partnerships demonstrate how networks extend influence and align around policy change. These questions reveal communication channels, shared messaging, and power-building efforts.

26) Who do you coordinate advocacy or public communications with?

27) Which partners help you access policymakers or community leaders?

28) Who mobilizes stakeholders with you for campaigns or hearings?

29) Who shares media contacts or provides comms support to you?

30) List partners who endorse your policy positions or letters.

VII. Programmatic Service Delivery

These questions identify where services overlap and complement each other. They’re especially useful for mapping collective impact initiatives or coordinated systems of care.

31) With whom do you co-deliver services to the same clients/populations?

32) Who do you share protocols or curricula with for aligned services?

33) Who do you share facilities or equipment with?

34) Who do you exchange data (beyond referrals) for service improvement?

35) Who do you coordinate coverage by geography (to avoid gaps/overlap) with?

VIII. Equity, Inclusion & Lived Experience

Centering equity and lived experience is essential for authentic collaboration. These questions spotlight the partners ensuring inclusive engagement, accessibility, and cultural responsiveness.

36) Which organizations bring lived-experience voices you rely on for design?

37) Who ensures culturally responsive approaches in your work together?

38) Who do you partner with to reduce access barriers for underserved groups?

39) Which partners compensate community advisors with you?

40) Who do you co-create language access (translation/interpretation) with?

IX. Innovation, Learning & Capacity Building

Learning relationships foster experimentation and shared growth. These questions highlight where networks are testing new ideas, building capacity, and spreading innovation.

41) Who do you pilot new approaches with?

42) Who do you share evaluation findings or dashboards with to learn?

43) Which partners mentor your staff or host peer learning?

44) Who do you test data-sharing or tech integrations with?

45) Who helps you spread/scale proven practices into new settings?

X. Risk, Continuity & Emergency Response

Networks also serve as safety nets. These questions assess resilience—how partners prepare for and respond to disruptions, ensuring continuity and shared problem-solving in crises.

46) Who do you coordinate with for continuity of operations (COOP) plans?

47) Who are your redundant providers you rely on if a partner is unavailable?

48) Who do you escalate issues to when risks emerge (safety, privacy, quality)?

49) Who participates in tabletop exercises or emergency drills with you?

50) Who do you align surge capacity with (volunteers, temp staff, space)?

XI. Open-Ended Catch‑Alls (to fill gaps)

Every network has relationships that don’t fit neatly into predefined categories. These open-ended prompts give respondents the freedom to name overlooked or emerging partnerships.

51) Please list any additional partners essential to your success on [topic].

52) Who should you be working with but currently are not?

53) Which relationships are most critical to maintain in the next 12 months?

If you have additional suggestions for SNA questions, contact our team to share them. They might make it into our guide during our next scheduled update!

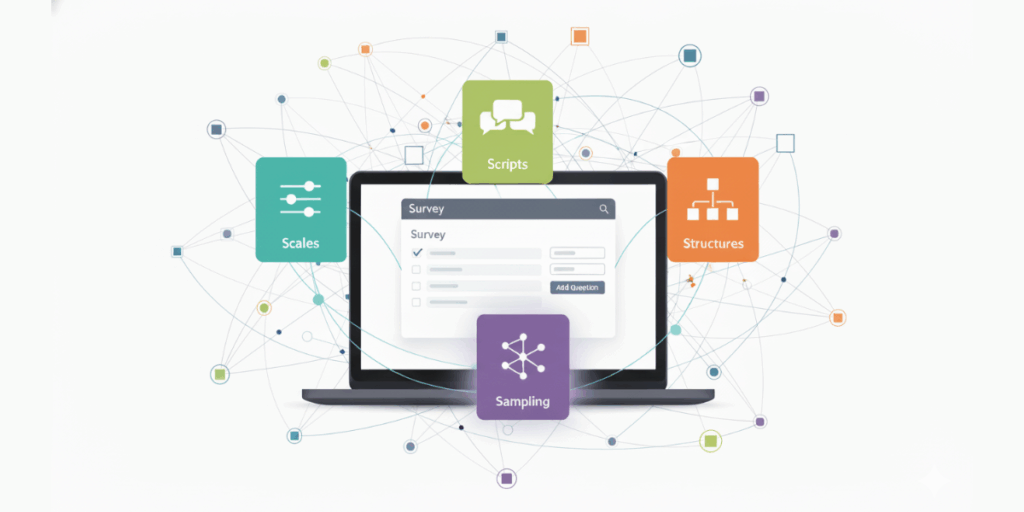

Using SNA Surveys, Scales, Scripts & Structures

Once you’ve gathered a solid list of relational questions, the next step is deciding how to capture and measure those relationships consistently. The following sections introduce tried‑and‑true data scales, survey scripts, and sampling approaches that make your results reliable and ready for analysis.

Whether you’re using PARTNER CPRM or another platform, these components help transform raw relationship data into actionable insights.

Relationship Quality Questions: Tie Strength, Interaction Frequency, and Intensity

When measuring relationships in an SNA survey, the right scale transforms raw responses into analyzable data that reveals collaboration dynamics and evolution over time.

Below are standardized, copy‑paste options that can be applied across projects for consistency and comparability.

How frequently do you interact with each partner in your network? [Choose one response for each partner]

- Never

- Once

- Quarterly

- Monthly

- Weekly

- Daily

💡Pro Tip: Use this to quantify contact regularity and identify core versus peripheral relationships. However, remember that frequency is not a proxy measure for trust or relationship strength.

At what level of collaboration is your relationship with this organization/program/department [note: the responses increase in level of collaboration]?

- None

- Awareness: We’re aware of what this organization does (e.g., understanding of services, offered, resources available, mission goals)

- Cooperative Activities: involves exchanging information, attending meetings together, and offering resources to partners (Example: Informs other programs of RFA release)

- Coordinated Activities: Include cooperative activities in addition to intentional efforts to enhance each other’s capacity for the mutual benefit of programs. (Example: Separate granting programs utilizing shared administrative processes and forms for application review and selection.)

- Integrated Activities: In addition to cooperative and coordinated activities, this is the act of using commonalities to create a unified center of knowledge and programming that supports work in related

content areas. (Example: Developing and utilizing shared priorities for funding effective prevention strategies. Funding pools may be combined.)

💡Pro Tip: More integration is not always better in a network as it consumers more resources and staff time. Most networks function best with a balanced mix of relationship intensities, only moving up the scale when it is needed.

What is the strength of your relationship with each partner listed below? [Helpful to define ‘strength’ for your context]

- Very weak

- Weak

- Moderate

- Strong

- Very Strong

💡Pro Tip: This question provides a quick, intuitive perspective on the strength of your relationships and helps you compare them. However, it lacks nuance and should be interpreted carefully.

Did they initiate with you?

- Yes

- No

- Unsure

Do you think they would report working with you?

- Yes

- No

- Unsure

💡Pro Tip: Combining objective and perceived reciprocity strengthens accuracy and interpretability.

These scales can be imported directly into your PARTNER CPRM survey templates, ensuring standardized data collection and seamless export for mapping, key player analysis, or longitudinal tracking.

Relationship Quality Questions: Validated Trust and Values Scores

Relationship quality is where SNA moves beyond connection counts to reveal how partners experience working together. These validated scales provide an easy way to quantify the trust, value, and satisfaction that sustain collaboration. Use them to benchmark relationship health, prioritize engagement strategies, and identify where relational repair may be needed.

Trust Score Indicator Questions

Assess the reliability, mission alignment, openness to discussion, and follow-through of each partner using a 1–4 or 1–5 Likert scale. Trust is the foundation for effective collaboration and can indicate readiness for deeper integration.

Value Score Indicator Questions

Measure each partner’s perceived power or influence, level of involvement, and contribution of resources. High-value ties often drive innovation and resource flow across the network.

Member Attribute Questions for Additional Map Layers and Analysis

Relationship quality is where SNA moves beyond connection counts to reveal how partners experience working together. These validated scales provide an easy way to quantify the trust, value, and satisfaction that sustain collaboration. Use them to benchmark relationship health, prioritize engagement strategies, and identify where relational repair may be needed.

- Organization type: Identify each partner’s category (public health, CBO, healthcare, education, government, philanthropy, business, resident-led, or other). This helps show how sectors interact and whether certain fields are underrepresented.

- Role and geography: Capture the respondent’s role (frontline, manager, executive) and geographic focus (ZIP, county, or region). Together, these fields help link network activity to decision levels and coverage areas.

- Populations served and focus areas: Ask about the groups or issues each partner supports. This makes it possible to map service overlap, identify coverage gaps, and analyze alignment with community priorities.

- Capacity indicators: Include staffing levels, program size, or resource capacity to understand potential bottlenecks or strengths across the network.

Adding these attributes turns your network map from a visual of relationships into a multidimensional tool for planning, evaluation, and equity tracking.

Sampling Methods:

Roster vs. Free Recall vs. Snowball

Selecting the right name generator method determines both the completeness of your network data and how much effort respondents must invest. Each approach has its strengths and trade‑offs—what matters most is matching the method to your project’s scope, known boundaries, and discovery goals.

1. Roster Sampling

Ideal for established collaborations or membership-based networks where the participant list is well-defined. Using a roster minimizes recall bias and ensures standardized partner naming, which makes data cleaning much easier. However, it requires upfront list hygiene and frequent updates to remain accurate.

2. Free Recall (bounded or open):

Best suited when your network includes external or emergent partners that may not appear on a fixed list. This flexible method captures new connections and unrecognized relationships. Plan for extra time to de‑duplicate responses and standardize organization names before analysis.

3. Snowball Sampling

Use when you need to explore an unknown or rapidly evolving network, such as mapping an emerging initiative or community ecosystem. Respondents nominate others who are then invited to participate, expanding visibility into the network’s periphery. To maintain ethical and manageable data collection, cap the number of waves (usually two or three) and clearly communicate how new contacts will be invited.

In Short:

- Roster sampling provides the most accuracy,

- Free recall sampling uncovers innovation,

- Snowball sampling reveals the unseen edges of your network.

Choosing intentionally ensures you balance discovery, precision, and respondent effort for the best possible insights

Ethics, Privacy & Consent Practices

Protecting respondent privacy and ensuring ethical data collection are core to high‑quality network analysis. A clear approach to consent and data management builds trust, increases response rates, and safeguards sensitive information.

- Collect only what you need: Limit questions to the minimum data necessary for your analysis. In reports or dashboards, use de‑identified data whenever possible and control visibility with role‑based permissions.

- Consent language: Offer separate consent templates for organizational and individual respondents. Each should outline the purpose of the study, how data will be stored, who can access results, and how long information will be retained. Emphasize voluntary participation and the option to withdraw.

- Handling personally identifiable information (PII): Define your data retention schedule and describe steps for secure storage and deletion. Avoid including sensitive personal identifiers unless they are critical to network mapping. Clearly communicate how you’ll protect confidentiality and share aggregated findings responsibly.

Following these practices not only satisfies IRB and compliance standards but also models the transparency and accountability expected in collaborative networks.

How to Use These Questions in PARTNER CPRM

Once you’ve crafted your survey and gathered responses, PARTNER CPRM helps you turn those data into insight. The platform’s tools make it easy to translate your raw relationship data into visuals, metrics, and trends that support better decision-making.

- Build your partner database and member profiles. Create a clean list of organizations or individuals, complete with attributes and sectors, so you can connect relational data back to real-world context.

- Setup your survey and import your question set. This step ensures your survey data flows directly into your network records without extra formatting or rework.

- Map and analyze relationships. Visualize your network, apply Key Player Analysis, and identify clusters, bridges, and collaboration gaps. You can also publish a public-facing dashboard to share outcomes with partners and stakeholders.

- Track change over time. Repeat your survey in future waves to monitor growth, relationship shifts, and impact. Longitudinal comparisons reveal which strategies and partnerships are making measurable progress.

To explore how PARTNER CPRM supports survey deployment, network visualization, and longitudinal tracking, visit the PARTNER CPRM page on the Visible Network Labs website.

Ready to put your network data to work?

Designing a strong SNA survey is just the first step—what matters most is turning those insights into action. PARTNER CPRM gives you a structured way to collect, visualize, and understand your collaboration data so you can make decisions grounded in relationships, not assumptions.

Whether you’re exploring your first network survey or refining a mature collaboration, you can learn how to apply these methods during a complimentary 1:1 PARTNER web demo. You’ll receive detailed information and resources to guide your next step in building stronger, more connected systems.