Network Evaluation 101

Tips and Tools for Practitioners

Network evaluation focuses on assessing the effectiveness of coalitions, collaboratives, and networks of community partners working together to achieve common goals, address complex problems, and create positive social change.

Network evaluation methods examine the structure and quality of connections among partners in a network. It assesses the effectiveness of network strategies and tactics, using both process and outcome metrics and measures. Network evaluation provides unique value by identifying the strengths and weaknesses of the network, its progress toward its goals, and providing actionable recommendations for improvement. It helps to understand network dynamics, including power relations, communication patterns, and decision-making processes.

Learn more and get started with the tools below in our complete Guide.

This Network Evaluation Guide covers all the main aspects of network evaluation. It includes methods, frameworks and tools, its relationship to developmental evaluation and social network analysis, advice for analyzing relational data, and additional resources and FAQs. To scroll ahead to a topic of interest, click the link below in the Table of Contents.

Table of Contents

I. What is Network Evaluation?

Network evaluation assesses the effectiveness of collaborations, partnerships, or networks of organizations or individuals working together towards a common goal.

It focuses on understanding the structure, function, and impact of the network, as well as the relationships, interactions, and processes within the network. Network evaluation typically involves the use of a range of methods, including social network analysis, surveys, interviews, and document analysis to gather data and assess the network’s performance, outcomes, and impacts.

The ultimate goal of network evaluation is to provide insights and recommendations to demonstrate and improve the network’s effectiveness and build its capacity to achieve its goals.

What Questions Can a Network Evaluation Answer?

A network evaluation answers unique questions by leveraging a unique type of analysis and data that better captures and quantifies numerous aspects of relationships. Here are some of the interesting and insightful questions that network evaluations can answer:

- What organizations are part of the network, and how are they working together?

- What are the benefits and challenges of participating in the network?

- Are more diverse networks more effective?

- Does more diversity in a network make it more difficult to manage (goals, outcomes, perceptions)?

- How vital is collaborative decision-making in networks?

- When there is more disagreement among reported outcomes and perceptions of success, does the network perform less effectively?

- What are the roles that powerful/influential members play in networks?

- What value do partners bring to networks?

- How should organizations invest resources to build and strengthen new partnerships?

- How are cross-sector partnerships leading to health and well-being outcomes?

- What kinds of resources are organizations leveraging collaboratively?

Networks and Developmental Evaluation

Developmental evaluation (DE) is an excellent fit for programs or initiatives that involve uncertainty, systems change, and complexity – which can be common in network situations. DE is a systems-based approach to evaluation; it provides a robust process for monitoring and supporting social innovations by working in partnership with program decision-makers.

Developmental evaluation exhibits the following characteristics:

- It is based on complexity, which allows for innovation and adaptation.

- It provides real-time feedback that generates learning and direction changes.

- It evolves, as new measures and monitoring mechanisms are developed to match changing goals.

- It captures system dynamics, interdependencies, and emergent interconnections.

- It aims to develop context-specific understandings to inform ongoing innovations.

- It draws from innovators’ values and commitments to learning, which is a key component of accountability.

- It enhances the ability to respond strategically, stay in touch with developments on the ground, and respond to events out of program control.

Network evaluation and social network analysis are common approaches in a DE project, due to their ability to capture and track interconnections and relationships within a system and how they change over time. The ability to visualize system dynamics makes network evaluation a perfect fit for developmental evaluations and evaluators.

II. Our Network Evaluation Framework

Visible Network Labs has its roots in the evaluation work. The University of Colorado Center on Network Science, founded by our CEO, Dr. Danielle Varda, developed a four-part Network Evaluation framework that we continue to use to guide our approach. In addition, we have developed a PARTNER method for implementing and assessing a broader network strategy; building on our evaluation framework by incorporating it into a larger continual process for performance improvement. Here is a brief introduction to our framework and process.

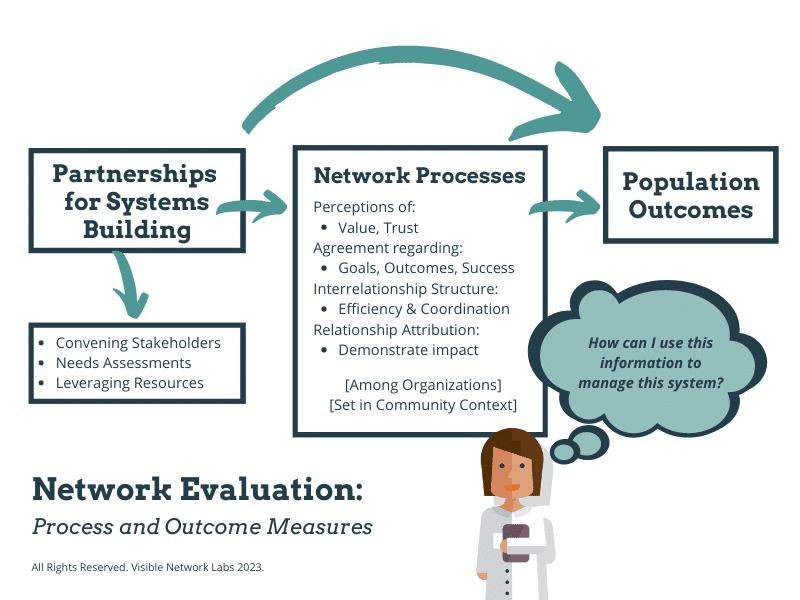

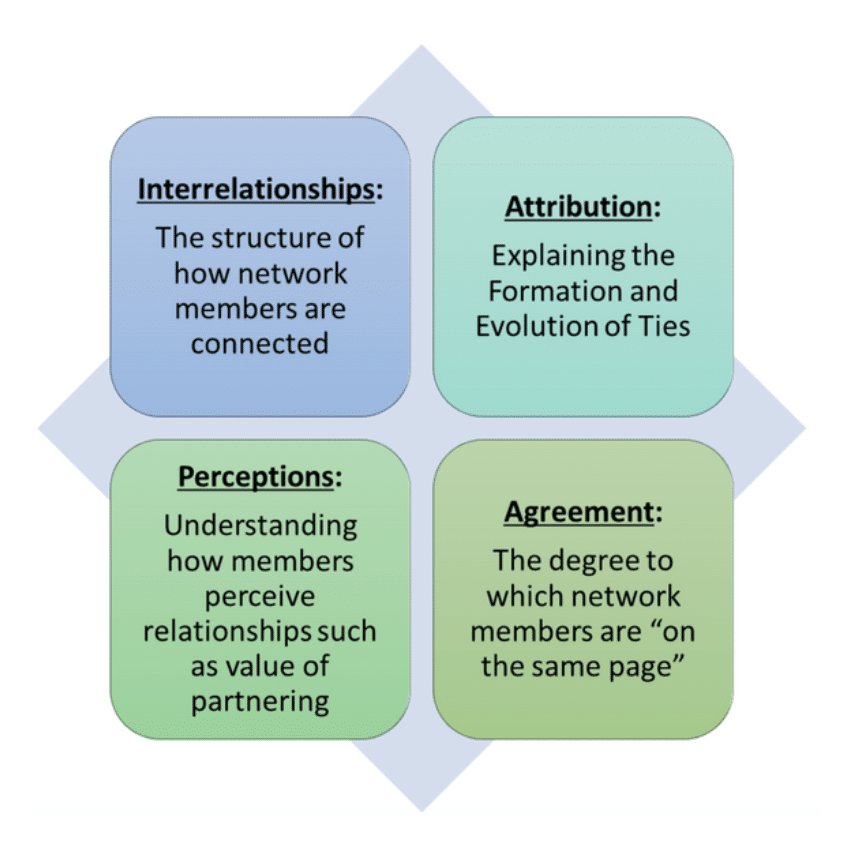

The network evaluation framework utilizes process measures to understand how a network of partner relationships is changing to better collaborate, share resources and information, and achieve their shared goals. Specifically, there are four areas of inquiry included in the framework. These include:

1. Interrelationships

1. Interrelationships

This metric involves measuring how each network member is connected to others. When viewed together, it helps identify gaps in the collaborative, its natural sub-groups and new partnership opportunities. Typically we utilize social network analysis for this part of the evaluation.

2. Attribution

This measures what each relationship is attributed to by asking how each partner knows the other. This is a powerful way to show how you’ve helped grow and strengthen the relationships in your network.

3. Perceptions

Our perceptions of one another – the degree to which we trust and value each other – is one of the most important aspects of any relationship. By measuring and mapping perceptions of trust, power, value, and resources across the network, you can identify powerful opportunities to strengthen your collaboration.

4. Agreement

Not everyone in a network has the same opinion on every issue. It is helpful to understand the level of agreement or disagreement about your network’s goals, priorities, and successes. Benchmarking your progress and gauging alignment across the partners in your coalition or collaborative is essential; wherever you find significant disagreement, set aside time as as a group to explore the issue and attempt to find some level of consensus.

Process vs. Outcome Measures in Networks

An important aspect of using SNA instead of other types of methods of evaluating networks is the focus on outcomes; particularly related to the types, and processes of networked relationships among people and organizations. SNA is different from other types of evaluation that focus on the characteristics of individual people or organizations, and how those factors impact behaviors and outcomes.

Outcome Measures

All networks aim to do something together they could not do alone. Some collaborate together to create community interventions and joint programs. Others exist to share and disseminate information, research, and new best practices across a community of practice. Outcome measures focus on quantifying the difference made by the network on the problem it wants to solve.

Process Measures

Process (or network) measures are different from population outcomes; they make up the intermediary outcomes that reflect the way that organizations interact, share resources, and implement work. These are often also known as process outcomes (see on the right). They emphasize the process that makes networks successful.

SNA lets us more systematically and accurately understand how building a network leads to individual and population outcomes.

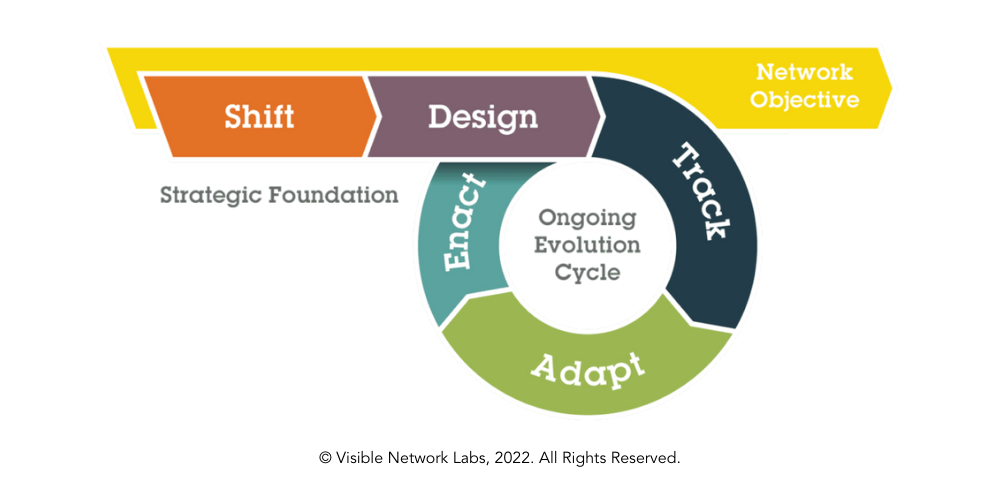

The PARTNER Method for Network Strategy Evaluation

After conducting network evaluations and research projects for nearly a decade, our team recognized a shift. Networks wanted a tool, and a process to track their progress and adapt their strategy continually over time, instead of relying on periodic and disjointed evaluations. Networks are dynamic and evolving systems, and require tools that constantly improve to manage them effectively.

Our team put their heads together and developed the PARTNER Method as a tool for network strategy development, design, and adaptation over time using an ongoing evolution cycle. Created in alignment with our network evaluation framework and social network analysis tools, it solves the problem of static evaluation by providing up-to-date data and analysis on the four key dimensions of network evaluation.

,

III. Using Social Network Analysis for Evaluation

Social network analysis uses relational network data to create maps and graphics that visualize the connections and relationships within a network. Furthermore, it allows you to layer different data on these maps to identify patterns and develop unique insights about the connections and quality of your partnerships. This makes it a quite useful method for implementing network evaluations.

While a social network analysis is relatively simple in theory, it requires using software tools to do it effectively. Here is a high-level overview of how social network analysis works for network evaluation purposes.

What is Social Network Analysis?

What is Social Network Analysis?

SNA is the study of the structural relationships among interacting players and the effect on the network (how those relationships produce varying effects). A network is an interconnected group or system. For this chapter, networks refer to a formal partnership created between three or more people or organizations to achieve mutually desired objectives, referred to as cross-sector, inter-organizational networks.

The fundamental property of this methodology is the ability to determine how connected players in a network are to one another. SNA collects data on who is connected to whom, how those connections vary and change, and focuses on patterns of relations based on the interconnectedness of nodes (which can be defined as people, organizations, or anything that you conceptualize as in the evaluation design). In a network map, nodes represent people, places, organizations, or other players, and the lines between nodes indicate the relationships that connect them and are defined by you in your evaluation design. SNA provides insights into individual or organizational connections and relationships, the nature of those relationships, and the role those relationships play in sharing knowledge and influencing behavior and outcomes.

1. Pose Evaluation Questions

Start by working with your partners to identify the key questions you want to answer. Make sure these are clear, measurable, and agreed upon before you start working on any other step, or you may have to stop and restart. If you need help thinking of ideas, try searching for examples of other online network evaluations, or read our examples in Chapter VII.

Common network evaluation research questions include:

- What organizations are part of the network, and how are they working together?

- How successful has the network been in achieving its goal?

- Which partnerships were created and/or strengthened through our relationship-building efforts?

- Where is trust strongest, and where can it be improved?

- What network strengths and weaknesses are relevant to their outcomes thus far?

- What are the biggest barriers for growing the network’s impact?

2. Bound the Network

With your questions prepared, you should consider who is a network member – and who is not. We call this process ‘bounding the network,’ and it is often one of the most challenging steps in the process. While some networks have formal, clear guidelines for membership, most do not – and even when they do, they often wish to reach some key stakeholders even though they are not officially a member.

For example:

Click here to read our full brief with advice for bounding your network.

3. Design the Survey

Your survey is the primary way you will collect network data. Each question you ask in your survey should directly help you answer one of the questions that is driving your evaluation. Some survey questions may apply to numerous key questions, but none should be irrelevant unless you have an overwhelming reason to include them (like being required by a funder). If there are questions you want to ask only some of your partners, you can use a survey program with skip and display logic to exclude irrelevant network members from answering specific questions.

It is always a best practice to pilot-test your survey with 3-5 members of the network’s core stakeholder group to get feedback before launching it more widely. This provides an opportunity to finish editing questions, catch bugs or errors, and keep the core stakeholder group involved and engaged.

Click here to read our network survey question suggestions

4. Collect the Responses

With the survey tested, you are ready to send it to your network and start collecting your network data. You will need to use a network survey tool to collect data – using a standard tool like Google Forms or SurveyMonkey will not work because of the unique way network data is captured and stored. We highly recommend using PARTNER CPRM – which has been used by more than 100 network evaluations for social network analysis, mapping, and reporting.

Start preparing for your survey by sending an introduction email to all your respondents. Share some background information about the evaluation, including its goals and how answering the survey will benefit them in the future. For example, they will get access to data about how they are perceived in terms of trust and value, and they will have a copy of the network map to demonstrate their collaboration to their stakeholders. If possible, tell them the exact day and time you will be sending the survey to help them expect it and plan ahead.

After sending the invite to take the survey, send a series of several follow up reminders to increase your response rate. If you do not get at least 40-50% of your respondents to reply, your data will be limited in accuracy and insight. We recommend sending three reminder emails every 4 days – and then sending an extension announcement that gives them one additional week to boost responses – before sending a last chance reminder the day before you close your results.

5. Map and Analyze the Data

5. Map and Analyze the Data

With your network data gathered, you can begin mapping and analyzing it. Every analysis is different, depending on the questions you ask and the methods you decide use.

We recommend working through your network data using the four dimensions of the Network Evaluation Framework. Here is a quick overview.

Interrelationships

Start by creating an overall network map with all the organizations who reported they are connected. This graphic is a great tool to start discussions with your network members. Here are a few ways you can use your network maps:

- Identify redundant partnerships to save time and resources

- Reconnect isolated members to the rest of the coalition

- Formalize and leverage sub-groups and niches that exist within the broader network

- Reduce bottlenecks in the flow of information and resources

Perceptions

A relationship is really just the sum of two partners’ perceptions of each other. In a network environment, perceptions of trust and value are especially important for building strong and effective partnerships. Here are several ways you can analyze and interpret relationship perception data.

- Prioritize relationships in need of stronger trust between partners

- Discover new resources and forms of value provided by network members

- Engage partners with strong mission alignment and the ability to be more actively involved

- Benchmark the quality of relationships to track progress in the future

Agreement

Consider where agreement in the network is strongest and where there were significant differences of opinion between partners. For example, if people tended to agree on your goals, but disagreed on how successful you have been, you may want to revisit your alignment regarding goal measurement and evaluation. It is likely your network members are defining or measuring success in different ways.

Attribution

Attribution gets to the source of relationships and lets you demonstrate which collaboration is a direct result of your network-weaving efforts. For programs that focus on building new partnerships and breaking down silos, these results are especially important to show the success of your interventions.

We provide a more detailed overview of social network analysis and relational data interpretation in Chapter V.

6. Interpret and Translate Data

The interpretation stage involves reflecting on the patterns and facts you identify through your mapping and analysis process. With visibility into the four dimensions of our evaluation framework, including the network’s interrelationships, perceptions, agreement, and attribution, you can begin working with your partners to identify action steps and key findings.

We recommend using an iterative and collaborative process to share your data with the group, and lead them through a discussion to generate insights and recommendations for the future. For example, when looking at the overall network map of your network’s structure, consider the following questions:

- Who are the most well-connected in the network? Are we leveraging their connectedness – if not, how could we?

- Are any network members isolated or at risk of losing their connection to the broader network?

- Does the network have all the essential partners at the table?

- If not, which partners are missing and what can be done to recruit them to the network?

- Are there any areas where additional, or fewer partners would help to strengthen the network?

- From your perspective, do your results accurately reflect the level of involvement from members?

- Is there an adequate level of involvement from the members of the network?

7. Create Reports and Share Findings

With your findings written and ready to share, the final step of a social network analysis involves creating and sharing reports, presentations, posters, and other graphics to share your findings with the broader community. In the context of network evaluation, this step is essential. Promising to make your data and network findings accessible to your partners is a fantastic way to promote buy-in earlier in the process and boost your survey response rates.

Networks often bring together a diverse array of community organizations with a range of perspectives and capacities. Try to ensure you are providing a range of report and graphic options to meet the different needs of the groups you are partnering with. Some partners may require some time with you to fully understand and leverage your findings and insights.

Click here to read our paper: Evaluating Networks with PARTNER

IV. Mixed Methods: Focus Groups and Interviews

Social network analysis and surveys of partners provide a rich source of data and information for network evaluation. However, some groups find it lacking a qualitative perspective on the impact and effectiveness of their collaborative. We generally recommend utilizing a mixed-methods approach to provide another layer of insight in conjunction with your network data.

The Value of Qualitative Data for Network Evaluation

Surveys and social network analysis methods are usually the initial step during a network evaluation. They often lead to unexpected discoveries or patterns identified by the evaluation and stakeholder team involved. Qualitative methods, like interviews and focus groups with members of the network, allow you to explore these discoveries directly to learn about their causes, impacts, and connections with other aspects of the network. They give greater depth and detail to the key points in your analysis.

Using a Mixed-Methods Approach

We recommend using qualitative and quantitative methods to inform and build off one another during your larger methodology. For example, beginning with a high-level survey can identify issues or barriers you can explore during stakeholder interviews – which in turn inform the questions you use for your final, in-depth network analysis survey. Alternatively, for networks with complex subject matter or problems, you might consider starting with interviews to provide the background information and context necessary to ask the right questions in a survey. Here are two specific methods to use.

Focus Groups

A focus group comprises around six to twelve individuals who possess comparable traits or share common interests and participate in a group interview. A facilitator directs the group’s discussion, relying on predetermined topics, and fosters an atmosphere that motivates participants to express their perspectives and opinions. Focus groups represent a qualitative approach for gathering data, which implies that the data is descriptive and lacks numerical measurements.

- Quick and relatively easy to set up.

- The group dynamic can provide useful information that individual data collection does not provide.

- Is useful in gaining insight into a topic that may be more difficult to gather through other data collection methods.

Interviews

Interviews are similar to focus groups but only involve one person at a time. There may be one or several interviewers, depending on the situation. Interviews are excellent for providing more depth or background information relevant to the evaluation. For example, you can use open-ended interviews with network members, and code the results to identify topics for questions in your survey later on.

Interview and Focus Group Resources

We found these interview and focus group resources helpful for our previous mixed-method evaluation projects. If you have any suggested tools or resources to feature, leave a comment at the bottom of the Guide. We love highlighting advice and links from our community of network practitioners and evaluators.

Focus Group Info Letter and Consent Template

A ready-to-use template for an information letter and consent form for evaluation focus groups.

Focus Group Moderation Guide Template

A Moderation Guide template for customizing and using during your focus groups.

Interview Info Letter, Guide, and Consent Form Templates

A bundle of Interview Templates, including info letters, consent forms, and interview guides.

Tips for Conducting Evaluation Interviews

A collection of tips for interviewing informants and stakeholders as part of your network evaluation process.

Guide to Interview Methods for Better Evaluation

A great guide on interview methods and best practices for all kinds of evaluations, including for networks.

Guide to Focus Groups Methods for Better Evaluation

A helpful overview of focus groups and their value in a network evaluation framework or approach.

V. Analyzing and Interpreting Network Data

Analyzing and interpreting network maps and data is challenging at first – but with practice it gets much easier over time. This guide is not a full how-to guide on social network analysis, but we do provide several examples on analyzing and interpreting network maps in the context of network evaluation.

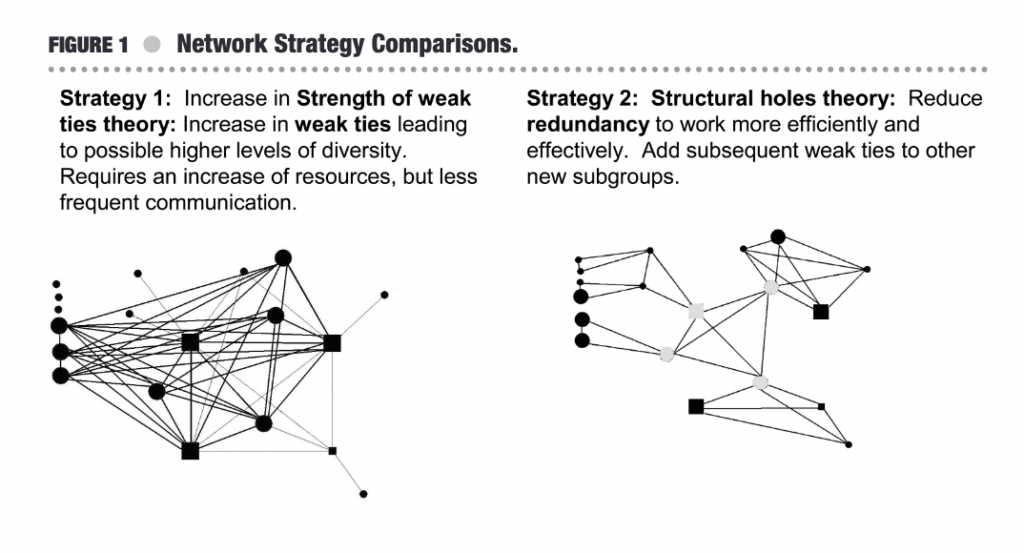

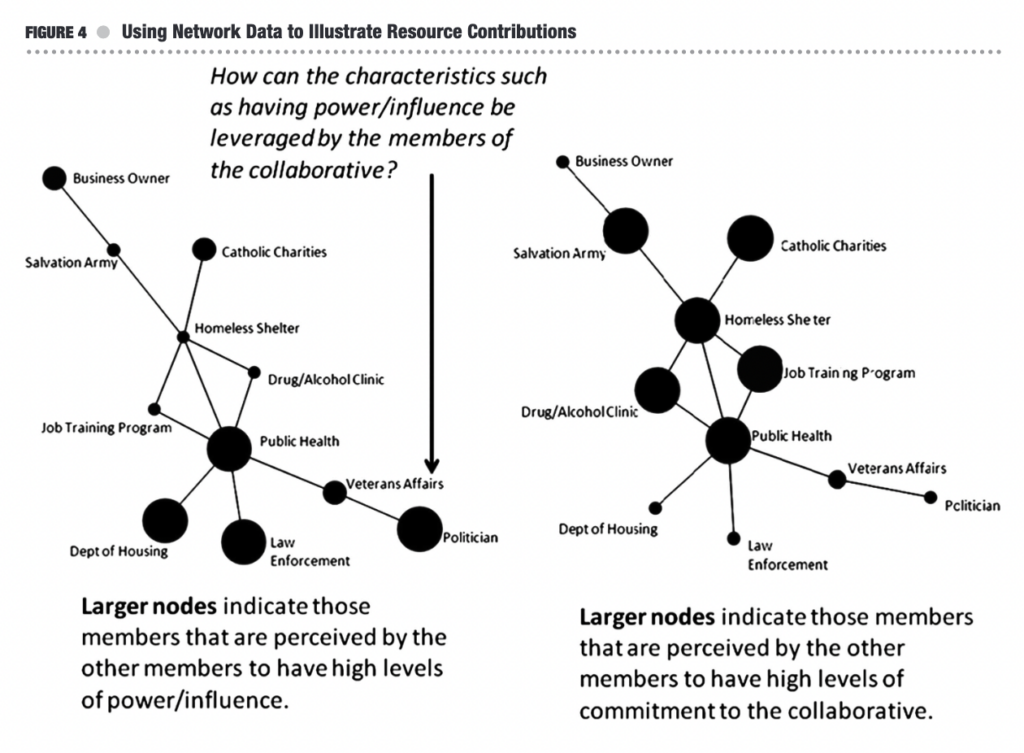

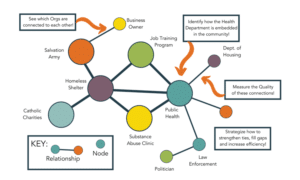

The graphics below come from our paper: Data-Driven Management Strategies in Public Health Collaboratives

Analyzing Interrelationships and network structures

Most networks don’t consider the structure of their interrelationships – but this often leads missed opportunities and waning engagement as the network becomes bloated. Network maps are a baseline and let you create strategies to build, alter, and restructure connections to take advantage of more strategic and efficient structures.

For example, the figure on the right shows two different network structure strategies that you might consider during your analysis.

The first strategy, the strength of weak ties, suggests that building ties to new contacts and acquaintances rather than to close colleagues and friends will lead to more diversity and opportunities – but requires more time and resources. The second strategy on structural holes shows how intentionally leaving space between partners and utilizing subgroups and bridges can save time while still allowing for connection to weak ties.

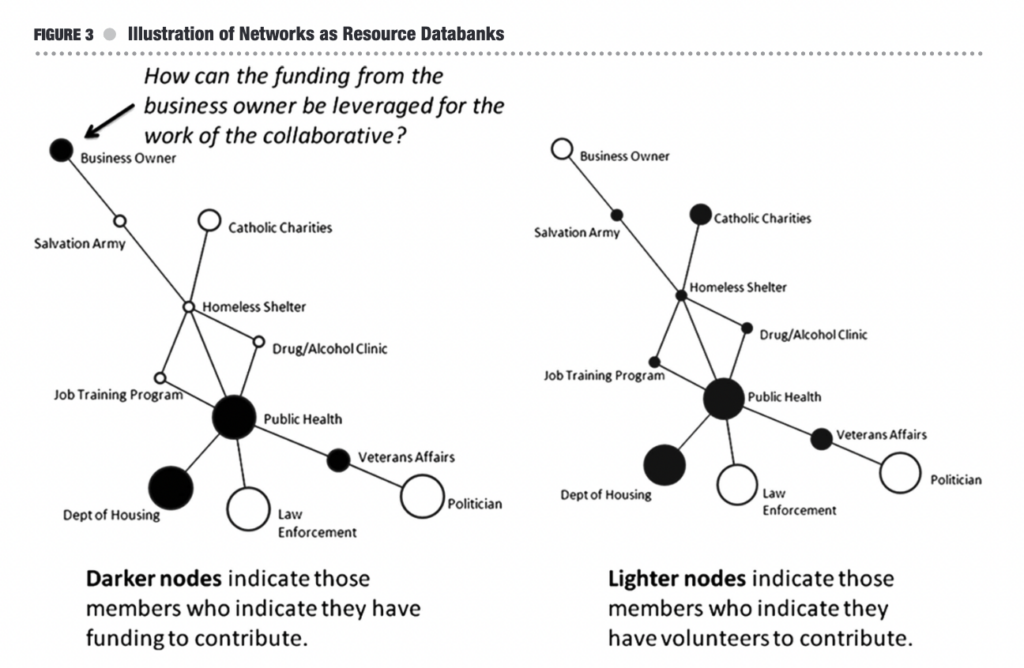

Identifying and Sharing Network Resources

Most networks involving sharing resources or information with other members of the collaborative. For example, the two network maps in the illustration on the right show which members can contribute funding or volunteers to a community health equity coalition led by a local public health department.

In the network on the left of the illustration, the business has funding available, but they are only connected to the central entity through two intermediaries. The public health department should contact the Homeless Shelter and Salvation Army to connect with the business owner more directly.

In the map on the right of the illustration, the lighter nodes have volunteers to contribute to the coalition’s work. For example, the politician has volunteers and can be reached through the network’s contact at the Office of Veterans Affairs, which reported they have a strong connection with the politician’s office. Layering resource data in this way can provide evaluators with a treasure trove of insights to improve how partners share and leverage assets, like funding and staff time, or information like lived experiences and subject matter expertise.

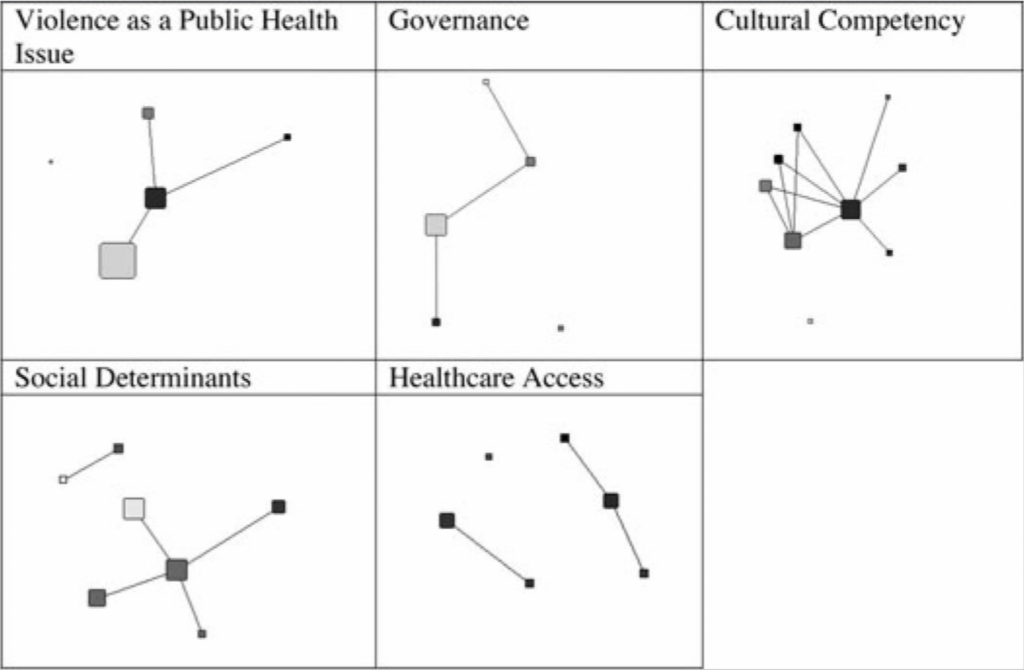

Perceptions of Value and Trust Between Network Partners

In a project in 2014, our team conducted research with several individuals building and managing public health collaboratives. Through interviews and focus groups, we identified the relationship dimensions that made networks successful: trust and value.

In place of authority in hierarchies, trust is the glue that holds networks together and the engine that gets things done. We measure trust by combining how an organization is viewed in terms of its:

- Openness to communication

- Reliability and follow-through

- Organizational mission alignment

The second key to successful partnerships are value-creating connections, which provide some tangible shared benefit that helps the network achieve its shared goals. Partner value comes in many forms, including three broad categories identified through our interviews:

- Shared Resources: Funds, staff, volunteers, in-kind donations, office space, subject matter expertise, lived experience, etc.

- Active Involvement: A willingness to roll up sleeves and show up to get things done.

- Power and Influence: The ability to affect decisions and get things on the community agenda.

All three forms of partner value are important and should be considered during the course of your network evaluation.

VI. Network Evaluation Examples From the Field

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Using SNA to Evaluate a Community Initiative - Three Hive Consulting

This evaluation conducted by Three Hive Consulting used the PARTNER Platform to evaluate a community initiative. Here are some findings they reported:

They presented network maps to their evaluation sub-committee and together, we worked to make sense of the data. Some maps and insights were more relevant, and inspired ideas for action based on who could be collaborating more, or which two unconnected partners might work well together.

When we compared each partner’s degree of trustworthiness with how well connected they were, an interesting pattern emerged. Visualizing these results allowed us to identify partners who were highly trusted but not well connected.

One participant reported: “The recommendations in the final report have been very valuable and will inform strategy, especially over the next 11 months…[for example] we are working to improve our communication with partners and employing a number of different methods. We have intentionally started… to share information and to host projects and groups. It is working.”

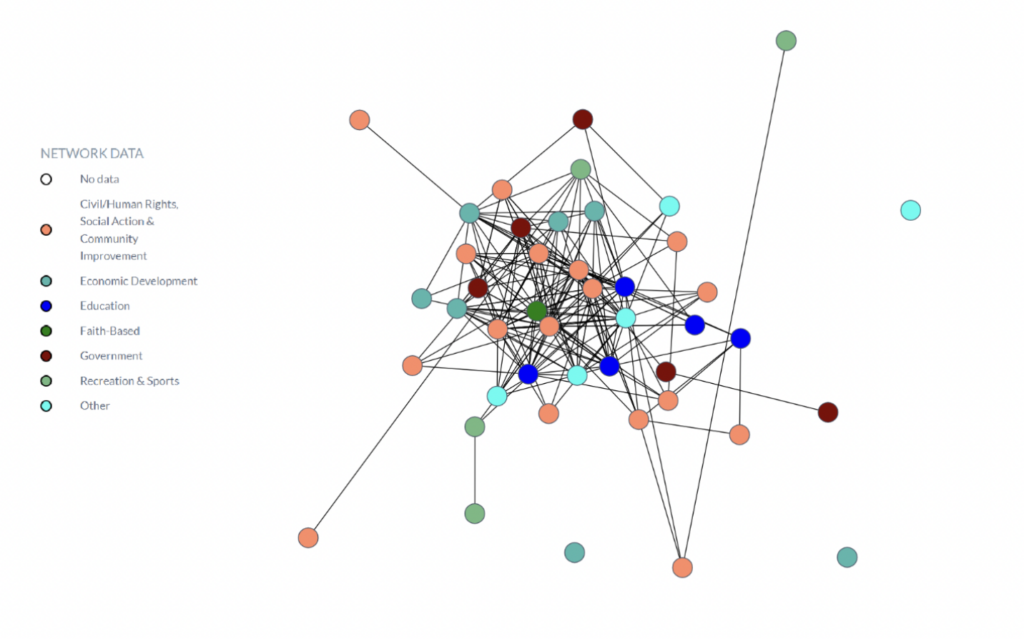

Evaluating a Local Public Health Network - Marion County Public Health Department

Marion County Public Health used PARTNER to conduct a social network analysis of their local public health system to visualize their partners and guide their strategic planning efforts.

In total, 59 organizations were identified as part of the Marion County public health system, and were sent the PARTNER survey to participate in the SNA. Of the 59 organizations that received the survey, 40 organizations responded from seven different sectors.

Their evaluation led to the following recommendations:

- Encourage involvement in the network, while building strategies to ask for the fewest required number of meetings.

- Explore possible incentives to participate in network activities.

- Consider the potential for leadership role definition in the network.

- Develop strategies that help increase perceptions of the value that building partnerships among members of the Marion County public health system brings to the network.

- Consider whether the level of activity among members is sufficient to meet the goals of the network.

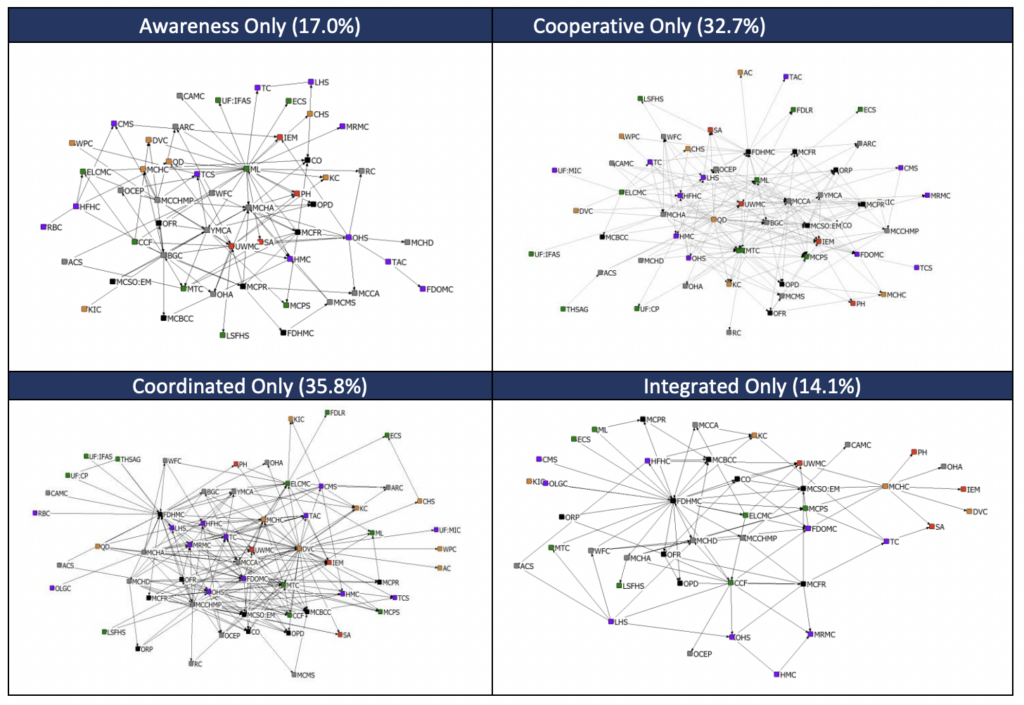

Social Network Gap Analysis Evaluation - A Case Study of the Southeastern Health Equity Council

SHEC is one of 10 regional health equity councils under the National Partnership for Action to End Health Disparities (NPA). It comprises 8 states in the American Southeast: Alabama, Florida, Georgia, Kentucky, Mississippi, North Carolina, South Carolina, and Tennessee. This voluntary association of 40 voting members (5 per state) is designed to bring together leaders from diverse backgrounds in both minority health and health disparity elimination.

Out of 40 council members, 32 council members responded to the evaluation survey.

The evaluation identified a significant gap in the number and strength of relationships between incoming and returning members (those with 2 or more years on the Council), leading to the recommendation of a new onboarding mentorship program to address the issue. It also revealed that not all council members are working as part of that council, and that there are distinct differences in the level of collaboration when comparing committees. To address this, they suggested improving committee engagement with members and learning from the practices of the most successful collaborative committees.

VII. Tools for Network Evaluators

Social network analysis requires special tools that can collect, clean, map, and analyze relational data. This is a critical difference; most survey programs are incapable of collecting and storing data using relational structures – columns and tables that show how different data points are connected to one another. This is how we can create network maps layered with additional data – on the backend, all the connections are stored in massive tables and charts.

Here are some network mapping and analysis tools you can use for your next evaluation or research project.

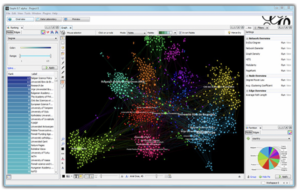

Gephi

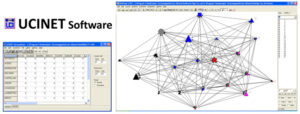

UCINET

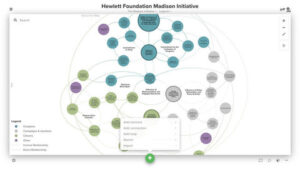

Kumu

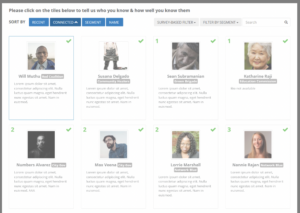

sumApp

PARTNER CPRM

VIII. Additional Resources

Looking for more information and resources about network evaluation? Here are some articles and guides our team recommends reading. If you know of other resources that we should add to our list, please leave a comment further below or share it in a message. We love sharing new tools and tips with our community, especially those coming from our community.

Evaluation of Networks - Annie E. Casey Foundation (April, 2010)

Produced by the Annie E. Casey Foundation, this Guide takes a funder perspective on this issue, and offers unique questions to consider when creating an evaluation for networks either you or others are funding directly.

Guide to Evaluating Collective Impact - FSG (June, 2017).

If you are evaluating a network utilizing the Collective Impact framework, this guide is for you. It includes three sections to address the different parts of the CI lifecycle. There’s also a great 90-minute webinar you can watch alongside it, which features real-world case studies and guest speakers.

Guide to Network Evaluation - Network Impact (July, 2014).

This State of Network Evaluation Guide includes a section with tips and best practices from the field, and a supplemental packet with examples and case studies from practice. It provides a good overview of the field, especially for those new to network evaluation.

Network Evaluation in Practice: Approaches and Applications - Center for Evaluation Innovation (July, 2015).

This PDF Guide from the Center for Evaluation Innovation shares a network evaluation framework that centers on three dimensions: Network connectivity, health, and results. It differs from our own framework, and provides another unique perspective on how to conceptualize a network evaluation implementation.

Evaluating Networks Using PARTNER: A Social Network Evaluation Tool - Visible Network Labs (March, 2020).

This published guide walks you through the process of evaluating a network using PARTNER [Program to Analyze, Record, and Track Networks to Enhance Relationships]. This includes our validated trust and value scores, and our network science-based social network analysis methods and measures.

IX. Frequently Asked Questions

If you need to conduct a network evaluation on a budget, consider using sumApp and Kumi. While it requires more time and isn’t as detailed as a PARTNER CPRM network map, it will still provide fundamental insights regarding your network’s structure. However, you won’t be able to layer on relationship quality scores like trust and value – and your options for reporting and sharing data with partners are much more limited as well.

Many traditional network science measures and metrics can inform a network evaluation process and final recommendations. For example, the three kinds of network centrality can help identify different types of key players in the community, and help analyze whether they are strategically connected to the rest of the network. Measures of density serve as a proxy for the degree to which the network is open vs. closed – which works best for different situations and contexts. Our validated relationship perception scores, including trust and value, provide targeted insights to build trust and create more value from your partnerships.

If you are conducting a network evaluation for the first time, it’s recommended to start by getting some fundamental network science knowledge. Before digging into your planning, work on shifting your mindset to a network perspective. Similar to systems thinking, it involves thinking about relationships, instead of entities, patterns, and flows instead of static assets and being aware of system dynamics like emergence and feedback loops. With this understanding, you will have an easier time developing research questions and selecting the right methodology.

Visible Network Labs does provide network evaluation services. Our team of data scientists and network science experts have conducted evaluations from planning through final reporting for more than fifty organizations and networks worldwide. Contact our Sales and Partnerships Team to learn more and get started.

Click here to learn more about our network evaluation services.

Evaluation is undergoing a shift across the field, away from ‘one-and-done’ evaluations that quickly become outdated – and is moving towards real-time assessments and quick iterations to provide constant updates to your approach. If you don’t have the means or software to do constant, real-time tracking and assessment of your network, we recommend surveying your members every 6 months to see how your collaborative is evolving. Surveying your network less frequently will mean your maps and data are out of date. However, deploying surveys more frequently than twice a year may overburden your partners and lower response rates.

If you feel your network is highly committed and engaged, you might consider sending a survey every 3-4 months. If your network is more informal and dis-engaged, you might decide to survey every 9-12 months. Decide based on your network’s unique context.

Connect with our Team!

Contact the VNL team to demo PARTNER™ or discuss a research or evaluation project. We can help you learn more about our services, help brainstorm project designs, and provide a custom scope based on your budget and needs. We look forward to connecting!

Email our team: hello@visiblenetworklabs.com

Send a message: Contact Us Here

1. Interrelationships

1. Interrelationships What is Social Network Analysis?

What is Social Network Analysis? 5. Map and Analyze the Data

5. Map and Analyze the Data